A recent story of Delta Flight 302 offers an instructive lesson about taking calculated risks.

With Hurricane Irma’s eye fast approaching, bringing 185mph, Category 5 winds along with it, this Delta flight to New York was the last plane to take off from Puerto Rico before the airport closed.

After landing in San Juan, the pilots faced a storm that was kicking in to high gear. The team, and Delta’s command center, realized that if the plane stayed there during the storm, it would probably be destroyed and the pilots and crew would be at risk. Plus … there were people waiting for the flight who desperately wanted to get off the island.

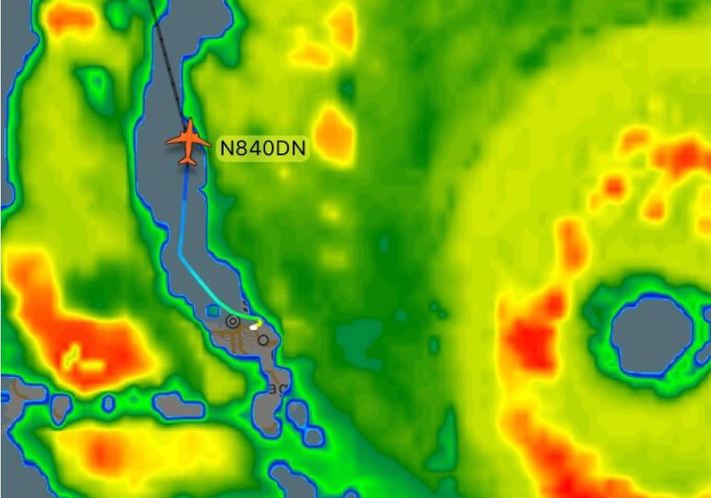

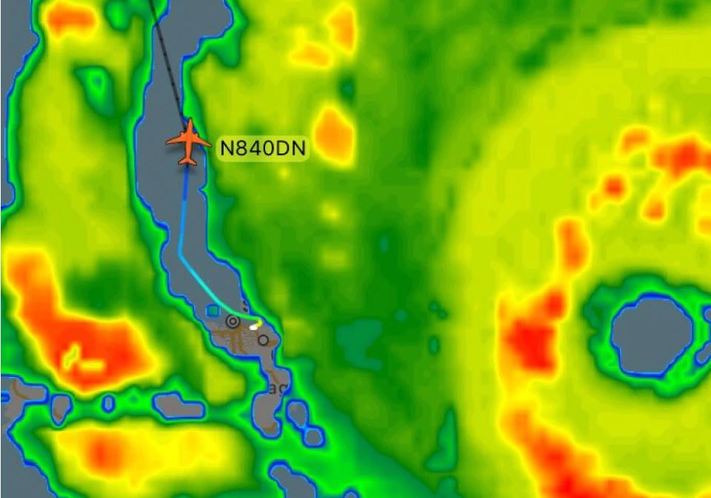

Consulting with meteorologists and experts in the Delta command center, the pilots knew from landing that there was a gap between the hurricane’s outer bands (storm rings) that was about to pass over the San Juan airport. If the plane took off within that window and stayed between the gap, it would have enough time to safely get above the storm.

The flight crew proceeded with this plan and escaped the storm without incident, much to the shock of many who were following the story as it unfolded.

(Flight radar image showing Delta flight 302 heading back to New York between the outer band of Irma and the eye of the storm).

What may have seemed like a reckless decision to some was actually a carefully calculated risk, one that involved prudent assessment and judgement.

Taking risk is an essential part of personal and professional growth, but it can often be a struggle to determine how much risk to take and when. If we never took any risks in life, we would not get very far.

However, when we take outsized risks, it can lead to disaster.

Here are a few things this story can teach us about how and when to take calculated risks:

- Your incentives are aligned: In Delta’s case, the pilot’s incentives were aligned with everyone else’s; their lives were on the line. If they felt safe, it was probably a good bet.In many companies, the opposite is true. Often, there’s a high upside for the person taking the risk if it pans out, but the downside isn’t commensurate. This is a phenomenon that’s plagued Wall Street for years and contributed to the subprime mortgage crisis.

- You have more information and/or experience: A situation that may look risky to one party is often not perceived the same way by another who has more information or experience. For example, a lot of military strategy is based on having better intelligence. In Delta’s situation, they had all their top people involved in the decision-making process – people who knew a great deal more about the variables than the lay observer.

- Your cause is greater than monetary gain: Taking a risk just for the potential financial upside (i.e. gambling) can often cloud our judgment. For a risk to be calculated, there needs to be a higher purpose. Sure, Delta wanted to save their plane, but they also knew that there was a crew and 173 passengers who desperately wanted to get out of a deadly hurricane’s path.

If you want to learn more about the Delta flight, watch this video of the flight taking off or read the coverage.

Quote of the Week

“Nothing will ever be attempted, if all possible objections must be first overcome.”

Samuel Johnson